The narrative, developed by the CII-ITC Centre of Excellence for Sustainable Development (CESD), provides a brief understanding of the science behind estimating climate finance requirements for India under different scenarios. It highlights significant investments required for India to shift to a low-carbon economy and the financial strategies that can be explored.

The findings underscore economic, environmental, and social benefits of transitioning to a sustainable, low-carbon economy. It advocates for supportive policy frameworks to mitigate risks and calls for robust financing structures.

CESD has put together this briefing to bring to light the issues & challenges around raising finance for transition. It is based on the views of global experts, Industry leaders and representatives from Government of India and international agencies. It captures data points from research done by multilateral agencies and development banks

Estimating the Climate Finance Requirements

Climate change action around the world involves a set of initiatives that lead to both reducing GHG emissions or mitigation action, and at the same time, create an enabling environment for building on existing capacities and resilience to worsening climate impacts or adaptation action.

At COP15 in Copenhagen (2009), developed countries decided to jointly mobilise USD 100 billion every year to address the needs of development and climate action in developing countries. It was decided that this funding is expected to be sourced from a mix of public, private, bilateral, multilateral, and other alternative sources of finance.

Climate finance is an important pillar for enabling transition in India

According to estimates by Reserve Bank of India, climate change is expected to impact India’s Gross Domestic Product (GDP) by 3 to 10 per cent by 2100.

The Reserve Bank of India's Report on Currency and Finance, released in May 2023, shares that the cost of adapting to climate change in India will reach a cumulative INR 85.6 lakh crore (USD 1.065 trillion) by 2030.

As per Ministry of Finance's Department of Economic Affairs estimates (Sub-Committee report for the Assessment of the Financial Requirements for Implementing India’s first NDCs), India requires investments worth almost USD 170 billion per year between 2015 and 2030, a total of USD 2.5 trillion (June 2020).

India’s Third National Communication to UNFCCC, which came out in December of 2023, states that about 5.5% of its GDP i.e. INR 13.35 trillion were spent in 2021-22 on ‘climate adaptation’. In the report, India shared that an additional INR 57 trillion will be needed over the 7 years for climate adaptation.

The New Collective Quantified Goal - India’s Submission

The NCQG aims to set a new financial target for supporting developing countries in their climate actions.

In 2024, India, in a submission to the UNFCCC on the New Collective Quantified Goal (NCQG), has called for developed countries to provide at least USD 1 trillion per annum year in climate finance to developing countries.

The submission states:

In line with the needs of developing countries, developed countries need to provide at least USD 1 trillion per year, composed primarily of grants and concessional finance. With the availability of the updated Needs Determination Report, the quantum can be scaled up in proportion to the rise in the needs of developing countries.

CESD Research on Financing Industry's Transition

The CII Mission Net Zero Initiative focuses on essential elements for India's transition to net-zero emissions. The report ‘Financing Industry Transitions’, released in May 2024, provides an in-depth analysis of financial strategies necessary for India to reach net-zero emissions by 2070. It highlights the significant investment required for India to shift to a low-carbon economy.

The findings underscore the economic, environmental, and social benefits of transitioning to a sustainable, low-carbon economy, ensuring fairness for all stakeholders. The report also advocates for supportive policy frameworks to mitigate risks and enhance the attractiveness of investments and calls for robust financing structures such as: Green banks & Carbon markets.

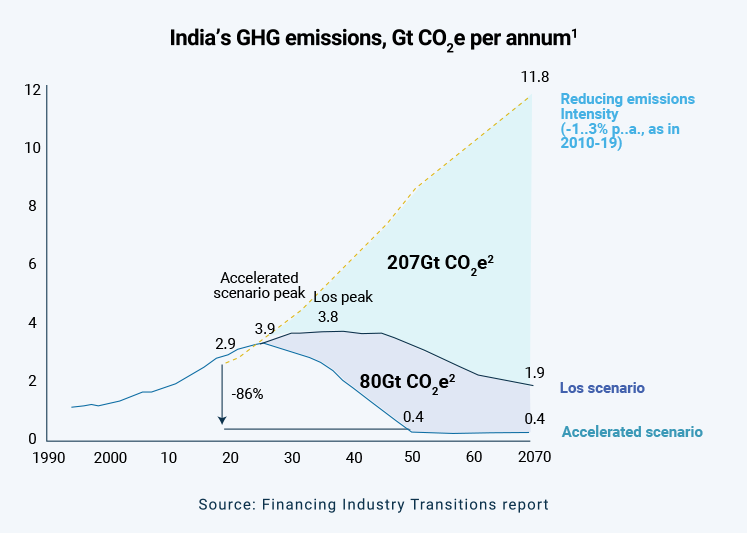

The report discusses emission reduction levers across two scenarios, both of which assume an orderly transition: The Line of Sight (LoS) / Business as Usual (BAU) scenario and the Accelerated scenario.

View ReportInsights from the Report

The LoS/BAU scenario with current (and announced) policies and foreseeable technology adoption.

The Accelerated scenario with further reaching polices like carbon prices and accelerated technology adoption.

In LoS/BAU scenario India could get to net-zero emissions by 2070, while in accelerated scenario, India could get to net zero by 2050.

According to estimates by CII-ITC CESD in the report, the transition will likely require USD 7.2 trillion to be invested in green technologies till 2050 for the LoS scenario.

Industry will require an additional investment of USD 4.9 trillion for the Accelerated scenario (3.5 per cent and 2.4 per cent, respectively, of cumulative GDP for the period).

These investments cover various sectors critical to reducing emissions

Green Power Generation

Hydrogen-Based Steel Production

Electric Vehicles (EVs)

Infrastructure

Agriculture

The present yearly green financing market in India is approximated at USD 44 billion, encompassing both debt and equity investments.

as per CII-ITC CESD's Accelerated scenario analysis, this figure could escalate to USD 160 billion annually (4.1% of GDP) within the current decade, reaching USD 440 billion in the 2030s (6.8% of GDP), and USD 610 billion in the 2040s (6% of GDP).

Investment Required for Enabling

Industry's Transition

Green Hydrogen

Investment of approximately USD 430 bn needed (till 2050) for green hydrogen production in the Accelerated scenario. USD 242 bn investment estimated to be required by 2050 in the LoS scenario.

Material Circularity

USD 660 billion capex investment by 2070 in Accelerated scenario; USD 440 bn estimated to be required in the LoS scenario.

Natural Climate Solutions

Around USD 160 billion investment estimated to be required by 2070; USD 50 bn needed in the LoS scenario.

Carbon Capture, Utilization and Storage (CCUS)

For achieving 3 GtCO2e cumulative CCUS, capex of USD 1.3 trillion would be required by 2070.

What Financial Trends and Trajectories Indicate – A CESD Perspective

- India needs substantial funding (3.5–6% of cumulative GDP till 2050) for its transition, which should begin this decade

- Over three-fourths of India's infrastructure for 2050 is yet to be built, with potential demand multiplying across sectors

- Policies stimulating demand signals within this decade can ensure low-carbon capacities in subsequent decades

- USD 7.2 trillion is needed for green technologies till 2050 for the LoS scenario, with an additional USD 4.9 trillion for the Accelerated scenario

- Investments are frontloaded, with a runway till 2040 to orchestrate half of the total required by 2050 (Accelerated scenario)

- Decarbonization could reduce operating costs by USD 2.1 trillion by 2050, mostly in the 2040s, easing cash needs

- Current annual financing for decarbonization meets only 10–12% of the investment demand in the Accelerated scenario

- Financing is constrained due to risks, necessitating aligned plans cascaded into appropriate industrial policies

- Measures such as accelerating the nationwide compliance carbon market and shaping banking regulations towards transition financing are vital for fast-tracking decarbonization

Suggestions Emerging from the Research

Defining Green Projects

- Clearly define criteria for green projects to prevent misrepresentation.

- Incorporate learnings from international best practices, particularly from Europe.

Carbon Markets

- Expedite the establishment of compliance carbon markets.

- Direct capital towards hard-to-abate sectors and promote green technology adoption.

Climate Risk Evaluation

- Integrate climate risk assessment into project evaluation processes.

- Align evaluations with IPCC guidelines to accurately assess climate-related risks.

Renewable Energy Lending

- Consider granting Priority Sector Lending (PSL) status to renewable energy projects.

- Facilitate access to financing for renewable energy initiatives.

Regulatory Actions

- Implement coordinated interventions by regulatory bodies to enhance finance availability.

- Streamline regulations to promote sustainable finance practices.

Market Solutions

- Encourage and incentivize investment in sustainable projects.

- Facilitate the growth of sustainable finance through grants and direct investments.

Infrastructure Enablers

- Ensure integrity and efficiency within the financial ecosystem.

- Develop industry-wide frameworks to support sustainable investment.

Capability-building

- Invest in education and training programs to develop expertise in sustainable finance.

- Foster the growth of a skilled workforce capable of assessing and managing sustainability risks.

Contributing to the Climate Finance Agenda through the B20 India Task Force on Energy, Climate Change & Resource Efficiency

The issue of climate change finance is a critical challenge for the global community, and the G20 countries have a crucial role to play in addressing it. G20 countries, as major economies, need to contribute to meeting the climate targets by increasing their climate finance commitments. This can be achieved through mobilizing public and private finance, as well as by leveraging innovative financing mechanisms.

Countries can also collaborate with developing countries to build capacity and promote knowledge-sharing on climate finance.

To facilitate this transition, the B20 took the lead in identifying and prioritizing actions for G20, as well as for allocating financial resources to support and pilot innovative solutions.

During India’s B20 Presidency in 2022-23, CII as the Secretariat for B20, was responsible for putting together consensus-based policy recommendations through 7 Task Forces and 2 Action Councils.

CII, as the Secretariat of the Task Force on Energy, Climate Change & Resource Efficiency, attempted to spur global economic growth by prioritizing critical action in the space of adaptation finance by working with Industry in India and outside.

The Task Force released a Policy Paper in August, 2023. The Paper shares four policy actions for G20 Members to enhance efforts to improve the availability of and access to climate finance:

- Introduce new and expanded low-cost financing options for energy transition by boosting and repurposing public finance, improving delivery channels and promoting local institutional capabilities.

- Establish a clear mandate for MDBs to support energy transitions via reforming operations, governance, risk-tolerance and fund alignment to provide concessional finance to emerging countries Policy action.

- Develop harmonised international carbon markets for monitoring and reporting emissions, accounting, transparency and environmental integrity Policy action.

- Secure investments in emerging technologies through Public-Private Partnerships and cooperation between developed and developing nations.

View report

Sajjan Jindal

Chair, B20 India Task Force on Energy Climate Change and Resource Efficiency and Chairman, JSW Group, during a session on B20 India Priorities Recommendations: From India for the World in New Delhi on 25 August, 2023.

Ramping up climate finance capital is lifeblood of transformation. We need more if it channelized towards green initiatives, especially the global south

Mark Carney

Brookfield Chair and Head of Transition Investing, During the B20 Summit in New Delhi in August 2023 shared the

re-orientations strategies for Multilateral Development Banks. This includes using existing balance sheets more effectively, focusing on transition finance and attention on key markets around voluntary carbon markets.

The second is to really focus on transition finance…. There is a reputational risk to have exposure to those.

Advancing Clean Energy and Climate Resilience

The Delhi Declaration in September 2023, accepted with 100% consensus, captured the intent of the G20 countries (responsible for 80 per cent of the global GHG emissions).

Noting that the progress on climate finance has been slow, the Declaration noted that the gap between actual flows and investment needs in developing economies was increasing.

Another significant achievement of India’s G20 Presidency was the formal acknowledgement of the jump in climate finance needed by developing countries.

Several recommendations from Task Force Policy Paper found alignment with the G20 New Delhi Declaration:

Clean Energy Technologies Development

- Acceleration of clean energy tech through co-ordinated policies.

- The need for a USD 4 trillion annually for clean energy technology to reach net-zero by 2050.

Industry Collaboration for Net-Zero Transition

- Support for collaborative efforts to achieve net-zero emissions.

- Focus on affordability and accessibility of technologies.

Decarbonization Pathways

- Developing strategies for ecosystem and supply chain decarbonization.

- Global commitment to net zero GHG emissions by mid-century.

Low-Cost Financing for Energy Transition

- Introduction of new financing options for energy transitions.

- Call for MDBs to support these transitions in emerging countries.

Presenting Indian Industry's Views and Suggestions COP 28

The G20 New Delhi Declaration played a significant role in reaffirming global climate action and by setting a precedent for the developed countries during the COP28, hosted in December 2023.

Negotiations at COP28 hold significant relevance for Indian Industry in their journey to contribute meaningfully to economic growth, development, and climate action in India.

Climate Finance was one of the five priority areas for COP 28. The objective, in terms of climate finance was clear for the forum:

- To ensure that finance for climate action becomes more available, accessible and affordable.

- To create an ecosystem that sees climate investment as an economic opportunity.

The agenda focused on innovative funding mechanisms, PPPs, access to international climate funds to mobilize the necessary financial resources and meet these ambitious targets while acknowledging the challenges in enhancing climate finance.

CII, along with the Ministry of New and Renewable Energy (MNRE) and the International Solar Alliance (ISA), discussed the industry expectations at the Round Table on Decentralized Renewable Energy for SDG7, COP 28.

Streamlining Indian Industry’s Expectations for Climate Finance

The report "Industry's Priorities for COP28, Dubai: Indian Industry Perspective” shared insights and outlined the anticipated actions and strategies at COP28, reflecting the perspective of the Indian industry. Some of the key suggestions were:

- Increased access to low-cost concessional finance through substantial replenishment of the Green Capital Fund.

- Capturing commitments by countries for the New Collective Quantified Goal

- Increased co-financing with the private sector.

- Government-backed procurement commitments towards sustainable and clean tec solutions

- MDB reforms and setting a clean energy mandate.

- Adaptation Financing.

Mr Jamshyd Godrej

Past President, CII

Chairman, CII Climate Change Council

Chairman & Managing Director Godrej & Boyce Mfg. Co. Ltd

“On the climate finance front, we all are aware about the significant monetary gap, and at COP28, countries should commit to low-cost concessional finance, in alignment with COP28 Presidency’s Goal and the G20 New Delhi Leaders’ Declaration to support developing countries in attaining their climate targets.

There needs to be commitment from organizations such as the World Bank Group, and governments to increase co-financing with the private sector through various measures to improve the risk-return nexus for private investors.

Carrying forward the momentum of recent positive conversations around multilateral development bank (MDB) reform will be crucial and setting a clean energy mandate for MDBs would go a long way towards accelerating energy transitions in developing countries and emerging economies.”

Edited excerpt from the Foreword Contributed for the CII publication (December 2023) - Priorities for COP 28: Indian Industry

Facilitating Indian Industry's Dialogues with Relevant Stakeholder at COP 28

“ In India, the second contributor (to GDP) after Agriculture is MSMEs, but both the sectors are deprived of banking. About 40% of the GDPs of emerging economies comes from SMEs and 90% business happens in SMEs. However, 40% of SMEs in developing countries have so far not met banking support. In fact, in India we have 64 million SMEs but not even 14% of these SMEs get financial support.”

Mr Pradeep Kumar Das

Chairman and Managing Director

IREDA Ltd

Session on Pioneering sustainability in MSMEs: Envisioning Global Growth and Local Impact

COP28 in Dubai

10 December, 2023

“While people across the globe have made commitments, the challenge lies in seeing whether those commitments have translated into disbursements. The commitment or signing a loan agreement is not the aim. The aim is that the money must reach the people who need it. That is very important because making a commitment is one thing and disbursing is something else.”

Mr Samir Ashta

CFO,

Apraava Energy

Session on Financing Industry Transitions in Emerging Markets and Developing Economies

COP28 in Dubai

8 December, 2023

“The key to attracting foreign investments is identifying the risks. They might be different from country to country, and even in the same country, they may vary over time. If we focus on risk rather than the tariff - that’s where the secret sauce lies. India has done it pretty well and over a period of time, they have got it right.”

Mr Rajiv Ranjan Mishra

Managing Director India Apraava

Energy Pvt Ltd

Session on Accelerating the Energy Transition: The Need for Collective Action

COP28 in Dubai

5 December, 2023

The Emerging Climate Finance Agenda

What is the role of Government policy, as well as global collaboration, in achieving the goal of sustainable economies. What innovative financing methods can accelerate this process.? How can businesses transform to reduce impact on the environment?

The session on Building Sustainable Economies at the CII Global Economic Policy Forum held in New Delhi on 7 December, 2023 deliberated on some of these urgent topics. Edited excerpts from the discussion are given below

Mr Karl Schmedders

Professor of Finance,

IMD

“Rich countries should pay a lot more than poor countries in the collective pot for the climate transition to take place in a favourable manner. The amount of disposable income the poor have to spend is much higher than the rich, when environmental policies such as carbon taxes come into effect”

Dr Richard Damania

Chief Economist,

Sustainable Development Practice Group, The World Bank

“For environmental sustainability to take place it is important to remove impediments such as excess subsidies on air, land, and water; and to create incentives in the form of repurposing subsidies, conducting sustainable trade, and creating environmentally favourable policies.”

Mr Sanjiv Puri

President, CII

(the then President-Designate, CII)

Chairman & MD, ITC Ltd

“Enterprises as large economic organs of society do play a pivotal role, given the financial and the managerial and research resources they have at their disposal.

Policymakers have a role to play to setting creating a level playing field, creating incentives and disincentives that can accelerate progress as well as for progress to happen.”

Dr Mekala Krishnan

Partner,

McKinsey Global Institutet

“It’s actually important to get the capital going for the cost competitive projects such as energy efficiency and to get the policy in place for the ‘low hanging fruits’. We also need to unlock the power of innovation and at the same time, look at new funding mechanisms.”

Stakeholders' Perspective on the Trillion Dollar Question -

Financing Climate Transition

The first Global Stocktake (GST) report clearly highlights that the world is not on track to reduce emissions to the level needed to limit global temperature rise below 1.5 C. Achieving these goals not only calls for systemic transformations at all scales but requires that we engage cities, states, countries, financial institutions, and others. These transformations will require us to unlock and redeploy trillions of dollars in climate finance to enable climate action in developing countries. A panel discussion was organized during the CII Annual Business Summit 2024. Panelists shared their concerns and also discussed:

How private sector capital can be mobilized and leveraged at a far greater scale

The collaborative role of MDBs, DFIs and other stakeholders

Forms of financing i.e. blended financing, hybrid capital

The need for underwriting foreign exchange fluctuations

“It is important to recognize what makes private capital reticent, what can be done to minimize and mitigate the risks, including regulatory risks, so that they can contribute to climate finance,” said Mr N K Singh, Member, High Level Committee on Simultaneous Elections, Co-Convenor, G20 Expert Group on MDB reforms, President, Institute of Economic Growth, and Chairman, 15th Finance Commission of India.

Mr Suman Bery, Vice Chairman, NITI Aayog, highlighted that that climate finance is both about addressing mitigation as well as adaptation needs. He suggested that perhaps clean technology projects could be bundled together along with capital from various sources in order to bring in greater private sector participation. “Climate finance is both about mitigation and about adaptation and adaptation, meaning as opposed the damage for climate change, and you know that India is very vulnerable to adaptation,” he added.

Mr Sanjiv Puri, President, CII and Chairman & MD, ITC Ltd, mentioned that there is no lack of private capital to invest in climate transitions. The key challenge remains that private capital will prefer to be directed towards investments with positive economic returns. In this regard, harmonizing policymaking to reduce friction will greatly help in making projects more financially viable from a business perspective.

H E Mr Pankaj Khimji, Foreign Trade and International Cooperation Adviser, Ministry of Commerce, Oman mentioned that the country is exploring options in green hydrogen and carbon capture projects. These projects will be executed in public private partnership modes in order to leverage private capital required. The projects will generate green hydrogen not only for Oman’s energy needs but will also be exported to other countries.

Mr Sumant Sinha, Chairman & CEO, ReNew pointed out that the cost of capital in India is very high and one of the key reasons behind this is India’s low credit rating. Pointing to India’s good track record in terms of payments, he suggested that credit rating agencies globally should revisit and revise India’s rating. This would in turn help increase climate finance flows in the country.

Financial Instruments & Mechanisms - Suggestions by Industry

- Consider carbon taxation and other fiscal policy options to enhance fiscal space for climate actions.

- Explore innovative financing models like guarantees, blended finance and hybrid capital structures to attract more private investment.

- Provide policy clarity and stability to reduce technology and investment risks/uncertainties.

- Develop debt capital markets and tap institutional investors to meet equity funding needs of the clean energy sector.

- Engage in dialogue with credit rating agencies to address perceived biases against developing countries like India.

- Revisit Basel III norms and standards to better account for differences in risks across geographies.

- Explore ways to bundle climate projects to present to private capital as investable portfolios.

- Need to reform capital market, banking system to meet investment needs.

Financing Climate Transition of the Indian Industry - CESD Recommendations

- Enhance International Collaboration: Engage in international platforms to share best practices, secure technology transfer, and attract investments for renewable energy and climate resilience projects.

- Promote Inclusive Climate Policies: Develop policies that ensure gender equality and the participation of indigenous and local communities in climate action, leveraging traditional knowledge and practices.

- Strengthen Subnational Engagement: Empower states and cities to develop localized climate action plans, facilitating coordination between national and subnational efforts.

- Leverage Innovative Financing: Explore innovative financing mechanisms to support climate projects, emphasizing the role of the private sector in achieving India's climate goals.

- Prioritize Technology and Capacity Building: Invest in clean technology development and deployment, focusing on capacity building to support a just and equitable transition to a low-carbon economy.

- Mobilizing Adaptation Finance: Replenish the adaptation fund, commit to operationalize the Loss and Damage Fund, include adaptation-related objectives in the National Adaptation Plan, and improve the speed of delivery, efficiency, and impact of climate change measures.

Insights by

Insights by

Aditya Raghwa,

Counsellor, CII

Narrative by

Narrative by

Diksha Gairola,

Associate Counsellor, CII

For more information write to us on cesdengage@cii.in