Raising Sustainable Finance for Value Chains – Takeaways from

Stakeholders’ Consultation

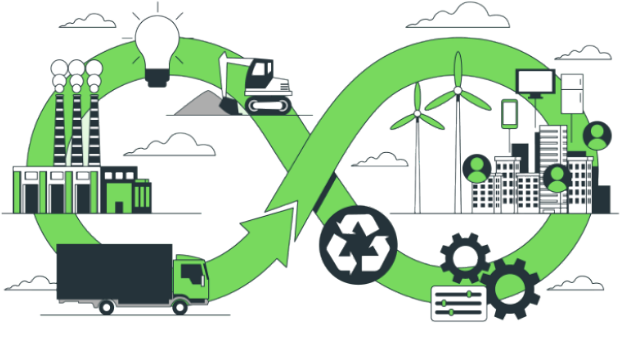

Sustainable finance is crucial for the transition of value chains. Insights from a recent stakeholder consultation highlight some of the strategies, solutions and tools that can be adopted by the value chains, says Priyanka Choudhary.

MSMEs form an integral part of India’s development trajectory and will require enhanced support and an enabling infrastructure to contribute to India’s net zero and sustainability goals. Incentives & schemes by Government, mentoring by Industry and financial support from institutions will be integral to the transformation of the value chains.

The CII-Centre of Excellence for Sustainable Development (CII-CESD) organized a roundtable on Sustainable Finance for Value Chains on June 11, 2024, in Mumbai to deliberate on the emerging challenges. More than 15 representatives from BFSI, manufacturing as well as MSMEs participated in the discussion.

Manufacturing sector in India and specifically the OEMs are transitioning their business models to integrate sustainable and green practices. This shift also impacts their value chains, requiring a holistic approach to sustainability. Sustainable finance is crucial for the value chains, particularly for SMEs, as financial support from institutions is essential for the transition.

To advance sustainable finance for value chains, there’s a need for clear direction through policy making, coalitions, collaborations with banks, right tools, and deliberations. One of the challenges that hinders decision making in providing sustainable finance to value chain companies is lack of sustainability related data.

Highlighting that both national and global mandates are driving organizations to collaborate with their value chains on sustainability, Mr Ajay Bhatt, Head of Corporate, Product, and Sustainability Strategy, Skoda Auto shared that to implement improvement plans, access to finance is essential.

Sustainable finance is a crucial and foundational step for embracing sustainability in value chains.

Mr Ajay Bhatt

Head of Corporate, Product, & Sustainability Strategy, Skoda Auto

Availability of reliable data to make sustainable lending decisions is a challenge.

Mr Roger Charles

Executive Director - Institutional Banking Group – Sustainability,

DBS Bank

Pointing out the roadblocks for financial institutions, Mr Roger Charles, Executive Director - Institutional Banking Group – Sustainability, DBS Bank shared that while availability of reliable data to make sustainable lending decisions is a challenge, the existence of various taxonomies and green lists from different countries further adds to this issue. He further highlighted that organizations in USA and Europe have started monitoring their Scope 1, 2, and 3 emissions but monitoring Scope 3 emissions poses a challenge as these emissions involve value chains spread across multiple countries, including those in the Global South, which often lack proper data and sustainability practices.

Mr Shailesh Bhandari, Director, B.U. Bhandari Dealership, noted that the cost of establishing sustainable projects is quite high, and consumers are not willing to pay a premium for sustainable products.

Mr Bhandari suggested for the creation of a measuring mechanism, such as a scorecard, to assess sustainable practices. This scorecard, he proposed, could be used by sourcing companies, banks, and the Government to provide incentives, ensuring that the cost is absorbed by value chain companies rather than being passed on to the end customer.

Sustainable finance options available in the market lack incentivization and are similar to normal finance options.

Mr Shailesh Bhandari

Director, B.U. Bhandari Dealership

Finance has a crucial role to play in the transition towards sustainable value chains.

Mr Shikhar Jain

Executive Director, CII-CESD

Underscoring the crucial role of finance in the transition towards sustainable value chains, Mr Shikhar Jain, Executive Director, CII-CESD emphasized on the need for a unified platform where different stakeholders can come together and provide solutions on integrating sustainability within value chains. He highlighted that CII, through the Eco Edge program, will focus on enhancing its data collection system, enabling various stakeholders to make informed decisions regarding sustainable practices within value chains.

Key Takeaways

Collaboration

among finance treasury, sustainability, and procurement departments is essential for transitioning to sustainable value chains.

Financial institutions

can scale up actions on value chain sustainability.

Supply chain finance programs

can be planned jointly by Industry and Financial Institutions to incentivize value chain partners by offering early payments.

Banks

can create portfolios of green funds, investing 60-70% in green projects such as renewable energy, water treatment plants, and waste management.

The startup ecosystem

should be engaged to introduce technological innovations for sustainable value chains.

Participants’ Suggestions for the CII Eco Edge Certification Program

The lack of consistent, verifiable, and decision-useful ESG data poses significant challenges for financial institutions in complying with regulations, managing risks, and making sustainable investment decisions.

Sectoral coalitions can be established, comprising stakeholders from sourcing companies, value chains, financial institutions, and industry associations.

These coalitions can collaborate to determine and implement standardised frameworks for value chain companies to report their sustainability data, thereby mitigating audit fatigue. Eco Edge can serve as a data repository for these institutions to facilitate decision-making and bridge the gaps.

- Eco Edge needs to be compatible with existing and upcoming national and international mandates on value chain sustainability

- It should also develop a separate framework for assessment of traders and service providers

- The program’s assessments, insights and maturity-level certificates can be considered as lending criteria for sustainability initiatives, bridging the gap between financial institutions and value chains

- The maturity-based certification program can be used by banks and sourcing companies to provide incentives to value chains, such as preferred status, early payments, extended contract terms, green purchase orders, and differentiated pricing compared to non-certified entities

By

Priyanka Choudhary

Associate Counsellor

CII